Summer Mortgages - Your move

By Lori Bamber, Managing Editor

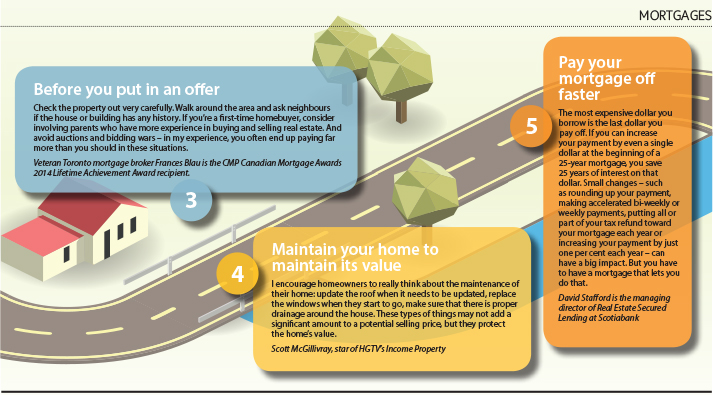

To help potential homebuyers and homeowners with an upcoming mortgage maturity do their best this summer, we asked three of Canada's leading lending experts for advice on choosing the right home and becoming mortgage free faster.

David Stafford

Managing Director of RealEstate Secured Lending, Scotiabank

While the marketplace benchmark tends to be the closed, five-year, fixed mortgage, it’s important to remember that life events don’t occur in 60-month intervals, says Mr. Stafford.

“You want to make sure your mortgage has features that permit life to happen. If you have a job change, have to move for some reason, have a growing family and decide to renovate – whatever might come up – you want to make sure you’ve got the features and the flexibility you need.”

When choosing a mortgage, says Mr. Stafford, your first question should be, “‘What are my options if I want or need to renew early, refinance or sell my home and move?’ There is a wide variety of features available, and some mortgages are very restrictive. It’s very important to understand what you’re getting.”

Similarly, payment flexibility is essential for those homeowners determined to save on interest by paying their mortgage off faster. “Many borrowers think of the interest rate as a proxy for cost, but the reality is that the total cost of a mortgage is the product of the amount borrowed, at what rate and for how long,” he explains. “With very low rate mortgages, the tradeoff is often payment flexibility – and time is the most expensive factor in today’s mortgages.”

Strategies that reduce the time and amount factors can result in life-changing savings, but those strategies only work with a mortgage that allows accelerated payments, he emphasizes.

Frances Blau

Canadian Mortgage Awards 2014 Lifetime Achievement Award honoree; President of Abacus Mortgages in Toronto

With more than 50 years of experience in the mortgage industry, Ms. Blau has seen many expert predictions proven wrong over time. “We heard that the condo market wouldn’t be great this year, for example – but that hasn’t proved to be the case.”

She feels that homebuyers are better served by worrying less about media reports on where interest rates and real estate markets are headed to focus instead on their own personal situation. When considering a home or applying for a mortgage, “Check everything very thoroughly,” she advises.

“Get expert advice from experienced professionals,” Ms. Blau adds. “Use a lawyer who specializes in real estate law, not in litigation; avoid mortgage brokers who also sell properties. Check out anyone you’re thinking about dealing with to make sure they’re reliable and honest.”

(The Canadian Association for Accredited Mortgage Professionals (CAAMP) provides links to industry regulators across Canada at www.caamp.org.)

One of the trends she has watched gain momentum, particularly over the last decade, is over-zealous buying. “I’ve seen young couples buy properties for half a million dollars and then struggle, even putting aside their plans to have a family.”

She recommends starting smaller. “Put all you can into it, sell it at a profit – work your way up to a bigger property.”

She also suggests that homeowners take a proactive approach to mortgage renewal. “A lot of people are caught up with their families and trying to make their payments. All of a sudden they get a renewal letter from their bank, so they just renew at whatever rate the bank is offering, without checking other options.”

Meeting with a mortgage broker three months in advance of the renewal date allows them to start early to check on the rates and features offered by a number of lenders. “If they do the mortgage for you, they get a finder’s fee from the lender – there is no charge to you. If they don’t, it’s just more information that you have to work with," says Ms. Blau.

Barry Gollom

Vice President, Mortgages and Lending, CIBC

“The expectation is that rates will eventually rise, but slowly,” says Mr. Gollom.

Current low rates provide a great opportunity to use interest savings to pay the mortgage down faster or for other savings or investment, he says. But he cautions that low interest rates alone won’t help homeowners pay their mortgage off faster, “The way to really benefit is to make payments as if we weren’t in a low-rate environment.

“We’re seeing more and more clients leverage this opportunity by taking simple actions that can make it possible to save tens of thousands of dollars, such as increasing their mortgage payment, making additional lump sum payments or increasing the frequency of their payments over the course of the mortgage.”

In addition to increasingly relying on the bank’s mobile mortgage specialists to help them overcome time constraints, more CIBC customers are opting for maximum borrowing flexibility, Mr. Gollom reports. “If you have equity in your home and want to renovate, for example, our Home Power Plan, a combined mortgage and equity line of credit product allows you to borrow what you need, when you need it. You then have the option of locking in the line of credit and paying it off as part of your mortgage, and as you pay down your mortgage, your line of credit automatically increases up to your available limit.”

Given the range of options, finding the right financing solutions starts with considering the home and financing in the context of a comprehensive financial plan, he stresses.

Answers to questions such as ‘Do I focus on paying my mortgage down faster or invest in an RRSP or an RESP?’ are unique to each individual, and expert advice can help homeowners make decisions that serve them in the future as well as the present, he explains.

“When applying for a mortgage, there are so many choices to make: fixed or variable, long or short term, features and conditions. We encourage our clients to think about how their mortgage payment fits with their life rather than how they can fit their life into their mortgage payment.

“Surround yourself with expertise: you owe it to yourself to take the time to understand all of the choices available by talking to a financial adviser and meeting with a mortgage adviser.”